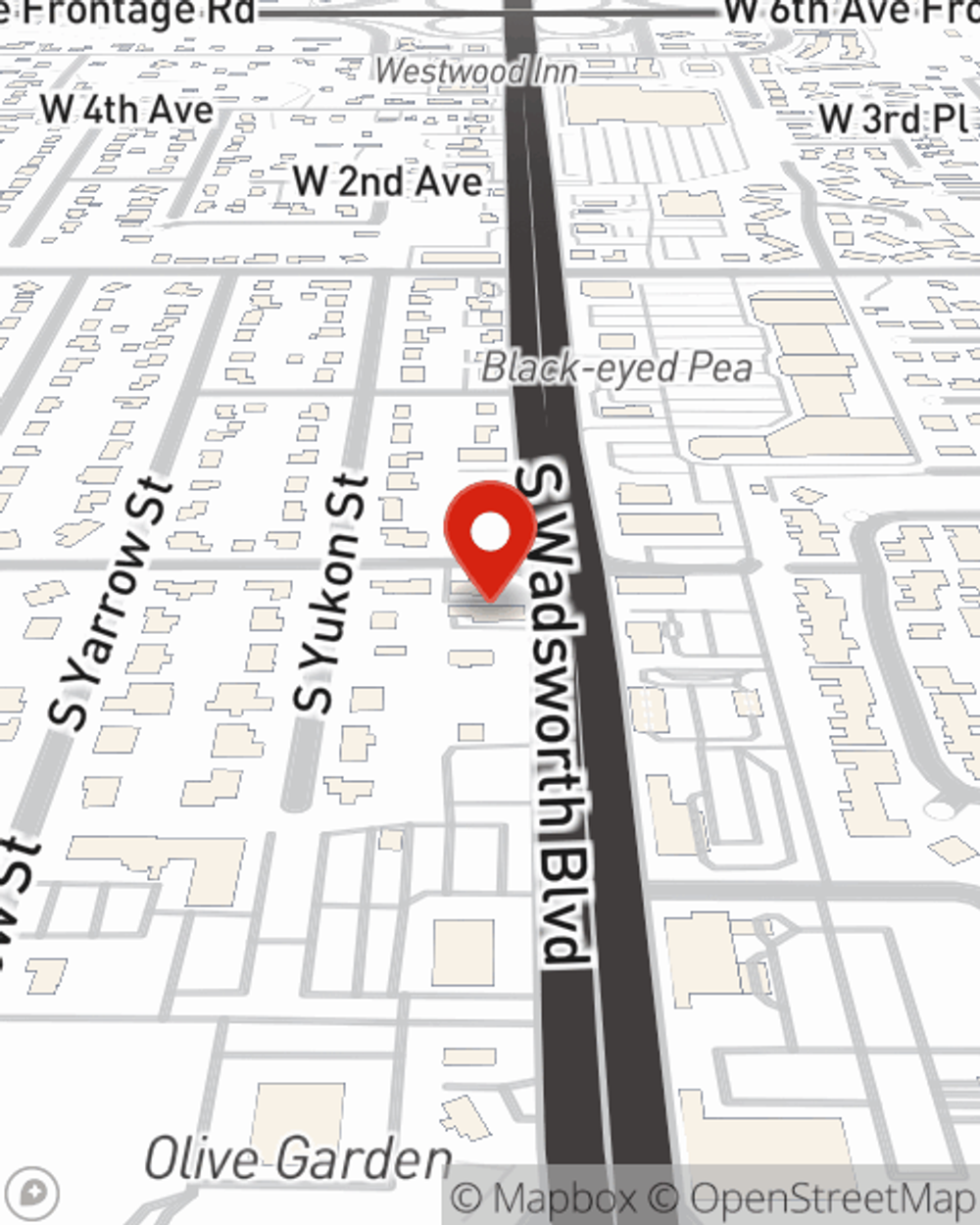

Renters Insurance in and around Lakewood

Looking for renters insurance in Lakewood?

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Lakewood

- Wheat Ridge

- Littleton

- Golden

- Arvada

- Denver

- Aurora

Calling All Lakewood Renters!

No matter what you're considering as you rent a home - size, furnishings, price, apartment or townhome - getting the right insurance can be crucial in the event of the unexpected.

Looking for renters insurance in Lakewood?

Renters insurance can help protect your belongings

Why Renters In Lakewood Choose State Farm

When the unanticipated fire happens to your rented space or property, often it affects your personal belongings, such as sports equipment, a bicycle or a stereo. That's where your renters insurance comes in. State Farm agent Gary Laskowski has the knowledge needed to help you understand your coverage options so that you can protect your belongings.

It's never a bad idea to make sure you're prepared. Visit State Farm agent Gary Laskowski for help learning more about options for your policy for your rented space.

Have More Questions About Renters Insurance?

Call Gary at (303) 238-8100 or visit our FAQ page.

Simple Insights®

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

Gary Laskowski

State Farm® Insurance AgentSimple Insights®

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.